To be eligible for fha loans the investment property has to be owner occupied.

Owner occupied multi family mortgage.

Freddie mac requires a 15 down payment on two unit owner occupant home purchases.

Originating mortgages secured by these types of properties through freddie mac mortgage products makes it possible to serve a greater number of borrowers with diverse financial circumstances and increase your community reinvestment act cra eligible originations.

Review current non owner occupied mortgage rates for october 2 2020.

The property is not occupied by the owner.

The main advantage of an fha.

You could work with a partner buy an owner occupied duplex with a down payment gift or ask the owner for seller financing with no money down.

3 to 4 units require a 20 down payment.

There tends to be a wider variation in loan terms for investment property mortgages which makes shopping multiple lenders more important.

Your interest rate will generally be higher on an investment property than on an owner occupied home because the loan is riskier for the lender.

Generally multifamily mortgage loan requirements include a down payment.

2 to 4 unit non owner.

A classification used in mortgage origination risk based pricing and housing statistics for one to four unit investment properties.

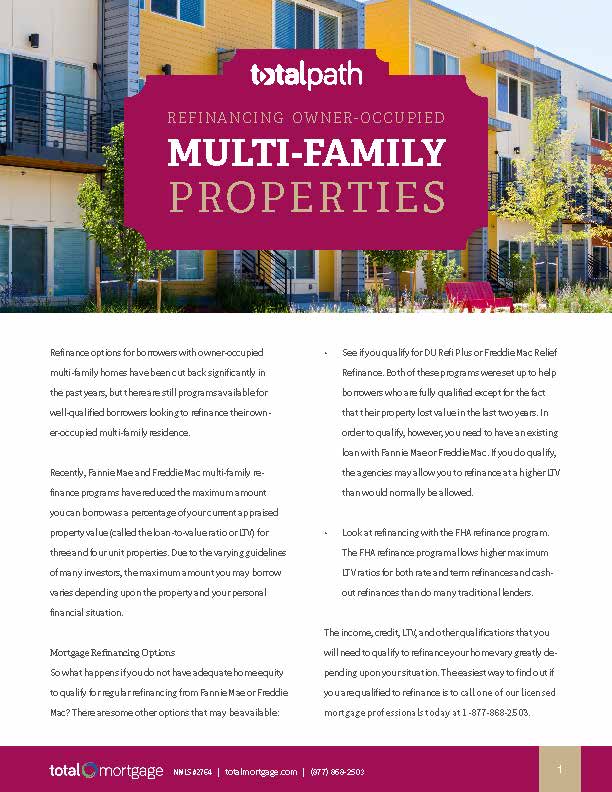

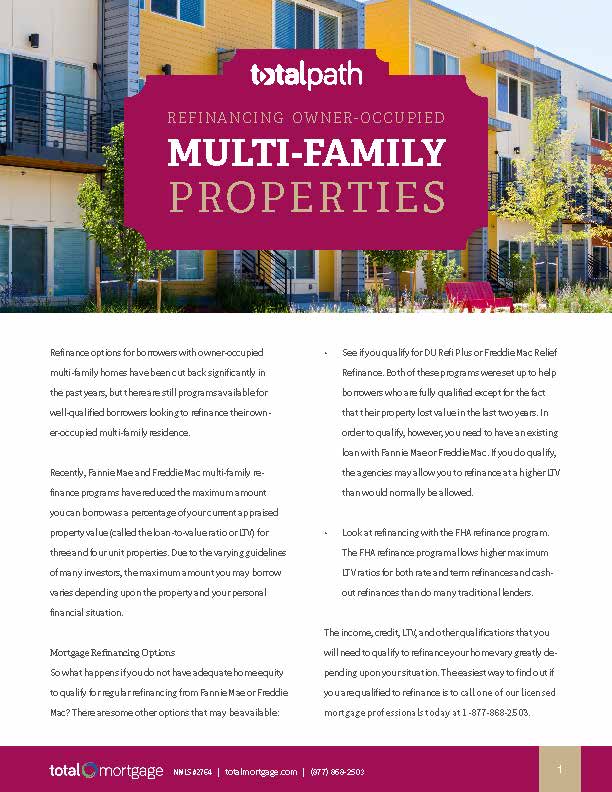

Multifamily mortgages are available for buyers of duplexes as well as of three and four unit dwellings.

Financing an owner occupied multi family investment.

Buying a duplex or multi family home with 3 4 units gives you the advantage of financing the investment using one of the following owner occupied multi family loans.

In many urban communities 2 to 4 unit housing is the key affordable housing inventory for primary residences.

Understanding the financing options that are available to investors is the first step in realizing the financial benefits of living in a unit of your multi family property.

A two to four unit residence that is owner occupied or a one to four unit.

Freddie mac home possible loan programs program allows as little as 5 for the down payment for 2 4 units with no income restrictions.

This could be as much as 25 for a multi family.